Inovative financing

and flexible payroll

Custom-tailored cash

flow for your business

Instant financing

available for companies

Inovative financing and flexible payroll Custom-tailored cash flow for your business Instant financing available for companies

The most beneficial financing for companies, available without debt or collateral. We offer employees the benefit of flexible payroll

The most convenient company financing.

Available immediately, without taking on debt.

We help companies grow and increase employee satisfaction.

Available financing and tailored cash flow

Stable financing or tailored cash flow that lets you time your expenses for a specific month of the year

Stable financing

Instant capital with flexible repayment terms.

Working capital for companies with stable cash flow. We’ll tailor the capital amount to your needs. Repay it when it suits you.

Seasonal financing

Tailored cash flow for your seasonal business.

Do you have unstable cash flow? For the agreed period of the year, we’ll create a tailored financing schedule based on your needs.

Annual interest rate: 4–10%

We guarantee the most competitive terms on the market. The interest rate depends on your company’s profile, capital amount, and funding duration.

No debt burden.

WageNow financing is classified as a short-term claim. It does not affect your existing credit terms or borrowing capacity.

Tax optimization and cost savings

By deferring payroll, you also delay tax payments, enabling tax optimization and reducing additional costs.

Annual interest rate: 4–10%

We guarantee the most competitive terms on the market. The interest rate depends on your company’s profile, capital amount, and funding duration.

No debt burden.

WageNow financing is classified as a short-term claim. It does not affect your existing credit terms or borrowing capacity.

Tax optimization and cost savings

By deferring payroll, you also delay tax payments, enabling tax optimization and reducing additional costs.

Our capital helps you grow

Our capital helps to grow these clients

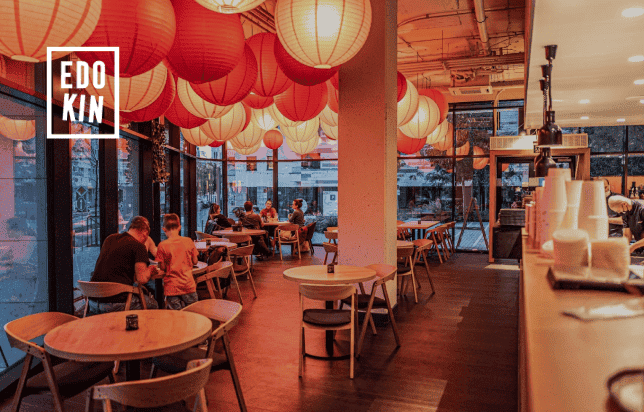

I’m very satisfied with WageNow’s services. I appreciate their excellent communication – they always respond promptly to questions and are willing to help The financing was a great support for us. We received capital when we needed it the most. I definitely recommend them.

– Cindy Offermanová, COO of EDOKIN Restaurants

Spoločnosť Váš Lekár má možnosť spolupracovať so spoločnosťou WageNow v oblasti financovania a radi by sme vyjadrili našu spokojnosť s poskytovanými službami. Naša spolupráca priniesla významné zlepšenia v našom cash flow riadení. Financovanie nám umožnilo rýchly prístup k finančným prostriedkom, čím sme mohli flexibilnejšie a efektívnejšie riešiť naše mzdové finančné kalkulácie.

– Denisa Andelková, HR specialist of Váš Lekár

Get working capital within 7 days.

Write to us and we’ll prepare a tailored offer for you.

We care about your data in our privacy policy.

The most popular benefit among employees

Flexible access to payroll anytime during the month

Your paycheck in just a few clicks – right in your account.

With WageNow, employees can access their earned wages anytime. No extra hassle for you.

- Work your hours

- Access your pay through the app

- Settle up at the end of the month

Companies

Increased Employee Retention

According to ADP (2022), employers who offer flexible pay as a benefit saw up to a 36% increase in employee retention.

Employees stay longer at companies offering EWA

89% of people stay longer at companies that offer flexible pay. Keep your talent and attract people from the competition.

Companies

Increased Employee Retention

According to ADP (2022), employers who offer flexible pay as a benefit saw up to a 36% increase in employee retention.

Employees stay longer at companies offering EWA

89% of people stay longer at companies that offer flexible pay. Keep your talent and attract people from the competition.

Employee

People with EWA manage their budget more effectively.

People with flexible pay manage their expenses better, handle their finances more efficiently, and are able to build financial stability.

People with EWA save more money each month.

Thanks to flexible pay, people are better prepared for unexpected expenses or can start building an essential financial cushion. This helps them avoid turning to costly loans.

Employee

People with EWA manage their budget more effectively.

People with flexible pay manage their expenses better, handle their finances more efficiently, and are able to build financial stability.

People with EWA save more money each month.

Thanks to flexible pay, people are better prepared for unexpected expenses or can start building an essential financial cushion. This helps them avoid turning to costly loans.

Benefit - satisfied employees

Our benefit has boosted employee satisfaction for these clients too.

Aktívnu spoluprácu sme začali v roku 2024. Či už išlo o proces nastavovania alebo aktívnu prevádzku služby, spolupráca bola vždy korektná. Naše požiadavky boli zakaždým riešené promptne a vďaka spoločnosti WageNow sme boli schopní našim zamestnancom priniesť nový moderný benefit „Výplaty kedykoľvek“. Spätná väzba od prvých kolegov, ktorí „Výplatu vopred“ už využili, je pozitívna a veríme, že benefit bude naberať na popularite.

– Katarína Lacková – HR manager NAY

Chcela by som vyjadriť svoju plnú podporu a pozitívnu skúsenosť so spoločnosťou WageNow. Spoločnosť Váš Lekár začala spolupracovať sageNow v od júna 2024 a sme maximálne spokojní s ich službami. WageNow nám poskytol moderné riešenie, ktoré umožňuje našim zamestnancom flexibilný prístup k ich výplatám. Tento inovatívny systém výrazne zlepšil finančné plánovanie a pohodu našich zamestnancov.

– Denisa Andelková, HR specialist of Váš Lekár

WageNow Benefit priniesol našim zamestnancom flexibilitu, ktorú si veľmi pochvaľujú, a nám uľahčil starostlivosť o ich spokojnosť. Spolupráca s tímom WageNow prebieha vždy hladko a spoľahlivo, takže môžeme službu len odporučiť.

– Vladimír Kamenec, Director of McDonald´s Tiebreak

Give your employees the most popular benefit.

Message us and we’ll create a tailored offer just for you.

We care about your data in our privacy policy.

Frequently asked questions

How does WageNow financing help companies gain financial flexibility?

WageNow unlocks working capital by providing fast access to financing, allowing companies to invest in growth, manage cash flow more effectively, and make smarter financial decisions.

Is WageNow financing a loan?

No, it’s not a loan. It’s short-term receivables financing that doesn’t impact your credit capacity or existing loan agreements.

What types of companies is WageNow best suited for?

WageNow is ideal for companies with 20 to 500 employees, especially those using digital attendance and payroll systems (though it’s not a requirement). It’s a great fit for SMEs and companies with seasonal cash flow looking to better plan wages and taxes.

How is WageNow financing different from traditional bank loans?

Unlike banks, WageNow doesn’t require complex approvals or physical collateral. The process is fast, flexible, and doesn’t reduce your borrowing capacity.

How can I apply for WageNow financing?

If you meet our basic criteria and are interested in WageNow financing, get in touch with us. We’ll be happy to tailor a solution that fits your business needs.

What impact will the WageNow benefit have on our company’s payroll?

None. The payroll cycle remains unchanged and all salary payments stay predictable. Employees can access a portion of their already earned wages, but at the end of the month, the company processes payroll in the standard way, you simply reimburse the amounts paid out.

When will we receive the data needed for payroll calculation?

You’ll receive all necessary data at the beginning of the new month after the withdrawal period for the previous month is closed, so there’s no disruption to your payroll process.

Can employees withdraw their entire salary in advance?

No, WageNow allows access only to a portion of already earned wages. Limits are set to ensure a stable payroll process and financial sustainability for both the employer and employee.

How does WageNow integrate with our payroll and attendance system?

We connect directly to your attendance and payroll systems, enabling automated payroll processing with no manual admin work for HR or accounting. The implementation is fast and seamless.

What are the costs for the company?

WageNow operates on a fixed monthly fee per employee. There are no hidden costs or additional transaction fees.

Does the WageNow benefit affect maternity or social benefits for employees?

No, WageNow has no impact on the calculation of maternity leave, sick pay, or other social benefits. Since the payroll cycle remains standard and salaries are processed at the end of the month, all deductions and entitlements stay the same.

Doesn’t WageNow reduce employees’ financial literacy?

On the contrary. WageNow helps employees manage their finances more responsibly by offering flexible access to already earned wages, helping them avoid costly short-term loans or debt. According to a Visa survey (2019), flexible pay helps 46% of people be better prepared for unexpected expenses and save more money.